louisiana state inheritance tax

472401-2426 effective January 1 2010. Its also a community property estate meaning it considers all the assets of a married couple jointly owned.

Louisiana Inheritance Laws What You Should Know Smartasset

Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax.

. No estate tax or inheritance tax. 822 repealed the state inheritance tax laws provided by RS. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate.

An inheritance tax is a tax imposed on someone who inherits money from a deceased person. When a person dies and leaves an inheritance the state must tax the wealth before the beneficiary collects their shares. For instance kentuckys inheritance tax applies to any property in the state even if the.

The inheritance could be money or property. All Major Categories Covered. 38 This is the first of six incremental reductions that will ultimately reduce the rate to 399 percent by tax year 2027.

If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws the SmartAdvisor tool can set you up with financial advisors in your area to help you plan your estate. Inheritance and estate taxesaka death taxeshave been legislated in a number of states across the country. Below is a chart that summarizes the details of the current laws that govern inheritance taxes in the six states that collect them.

However according to the federal estate tax law there is no Louisiana inheritance tax. Like the federal estate tax laws louisianas inheritance tax laws have undergone a lot of changes in the past several years. We have helped them obtain.

That is becasue an inheritance tax is a tax on the person who inherits the property not the estate itself. Unlike estate taxes inheritance tax exemptions apply to the size of the gift rather than the size of the estate. There is no louisiana inheritance tax for people who die after june 30 2004.

The tax is paid by the estate itself. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Louisiana does not impose any state inheritance or estate taxes.

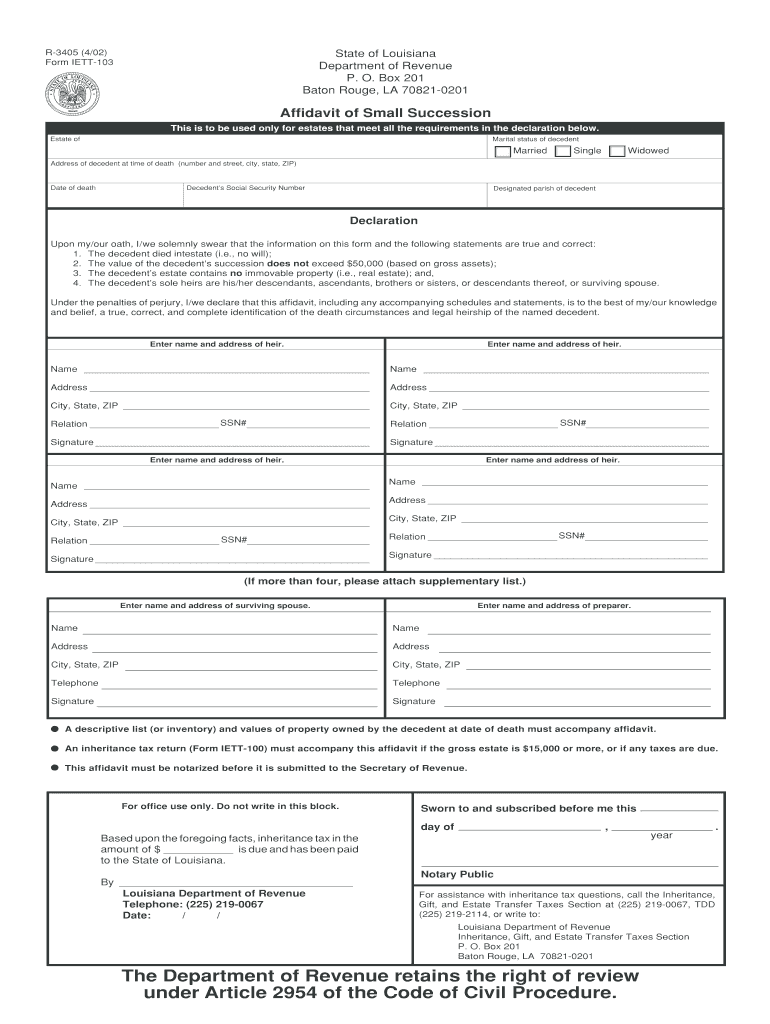

LOUISIANA STATE INHERITANCE TAX T he State of Louisiana has repealed all state inheritance taxes. Often in Louisiana one person will inherit the right to use property and receive the fruits income from property. 47187 will be required to file only if part of the income is taxable to the trust or if there are nonresident beneficiaries.

At the federal level there is only an estate tax. The 5 million exemption will return for deaths occurring in 2026 and thereafter unless congress votes to extend the larger exemption. Inheritance taxes are levied by the states.

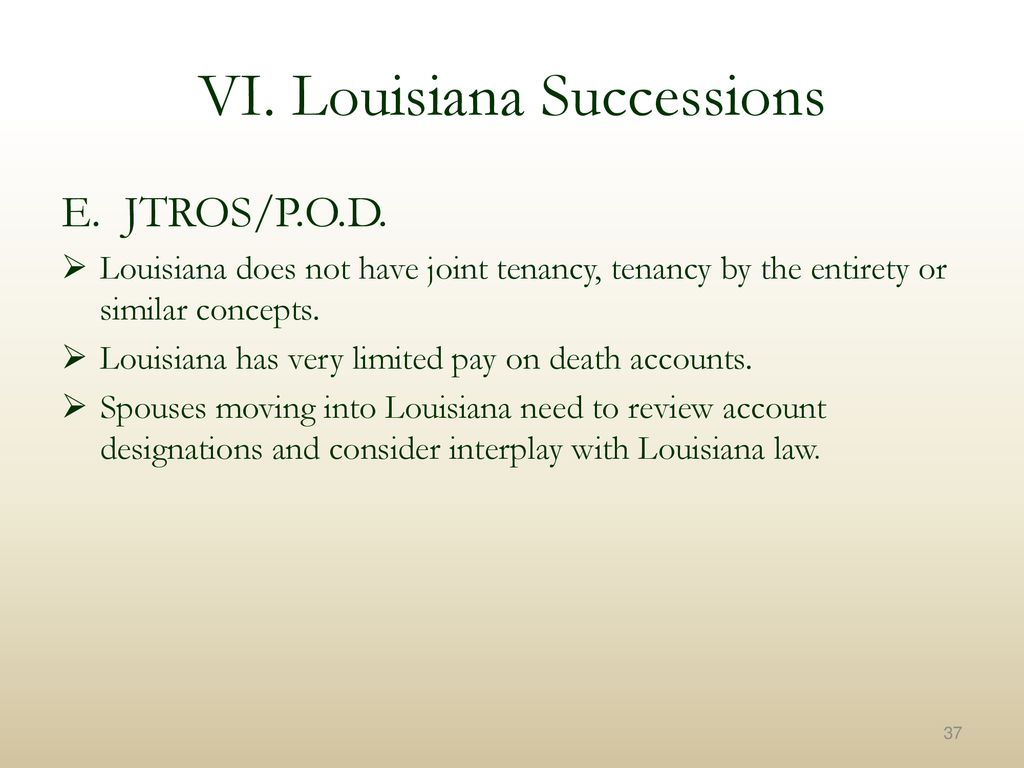

In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. This right is called a usufruct and the person who inherits this right is called a usufructuary.

But that wont be an. This means that in many cases an estate is taxed twice -- first by the federal estate tax then by the state inheritance tax. This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011.

For instance Kentuckys inheritance tax applies to any property in the state even if the inheritor lives out of state. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. The Louisiana Department of Revenue has issued a Revenue Information Bulletin RIB regarding inheritance tax receipts.

Total inheritance tax Forward to Line 4 Schedule IV Total due or refund due From Line 6 Schedule V 1401 Mail Date Schedule I Recapitulation of Detailed Descriptive List or Inventory Schedule II Preliminary Distribution and Calculation of Usufruct Schedule III Determination of Louisiana Inheritance Tax. Third and even more importantly for Louisiana residents if your estate is not structured correctly the property in your estate may be subject to. Contact Inheritance Advanced to Receive Your Inheritance Money In Louisiana Now.

It is a tax on the amount received and is paid by the heir. Louisiana Inheritance and Gift Tax. FEDERAL ESTATE TAX The Federal Estate Tax.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. All inheritance are exempt in the state of louisiana. If you are entering into the probate process in Louisiana and you need cash immediately inheritance advanced is here for you.

Louisiana does not have an inheritance tax. Inheritance tax occurs after the heirs receive their payouts. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

Under provisions of North Carolinas biennial budget bill signed by Governor Roy Cooper D on November 18 2021 the states flat income tax rate was reduced to 499 percent on January 1 2022. An inheritance tax is levied upon an individuals estate at death or upon the assets transferred from the decedents estate to their heirs. Inheritance Advanced has worked with more than 1700 satisfied clients across the country including state.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Louisiana state inheritance tax the state of louisiana has repealed all state inheritance taxes. Select Popular Legal Forms Packages of Any Category.

Louisiana state inheritance tax. Maximum allowable state tax credit 12400 Louisianas estate transfer tax With the transfer tax in place the 185000 is split between Louisiana and the IRS 12400 to Louisiana and 172600 to the IRS If Louisiana had no estate transfer tax the estate would pay the entire 185000 to the IRS. Thus there is no requirement to file a return with the State and no state inheritance taxes are owed.

Louisiana Intestate Law What Happens If You Die Without A Will In Louisiana

Louisiana Retirement Taxes And Economic Factors To Consider

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Louisiana Estate Tax Everything You Need To Know Smartasset

Laws Governing Estate Inheritance For Children In Louisiana Legalzoom Com

Louisiana Succession Taxes Scott Vicknair Law

Here S Which States Collect Zero Estate Or Inheritance Taxes

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Louisiana Estate Tax Planning Vicknair Law Firm

Where S My State Refund Track Your Refund In Every State

States With No Estate Tax Or Inheritance Tax Plan Where You Die

La Dor R 3405 2002 2022 Fill Out Tax Template Online Us Legal Forms

Inheritance Tax What It Is How It Works Filing Tips Benzinga

Texas T E Lawyer S Roadmap To Louisiana Law Ppt Download

Louisiana Health Legal And End Of Life Resources Everplans

Louisiana Estate Tax Everything You Need To Know Smartasset