bull flag pattern stocks

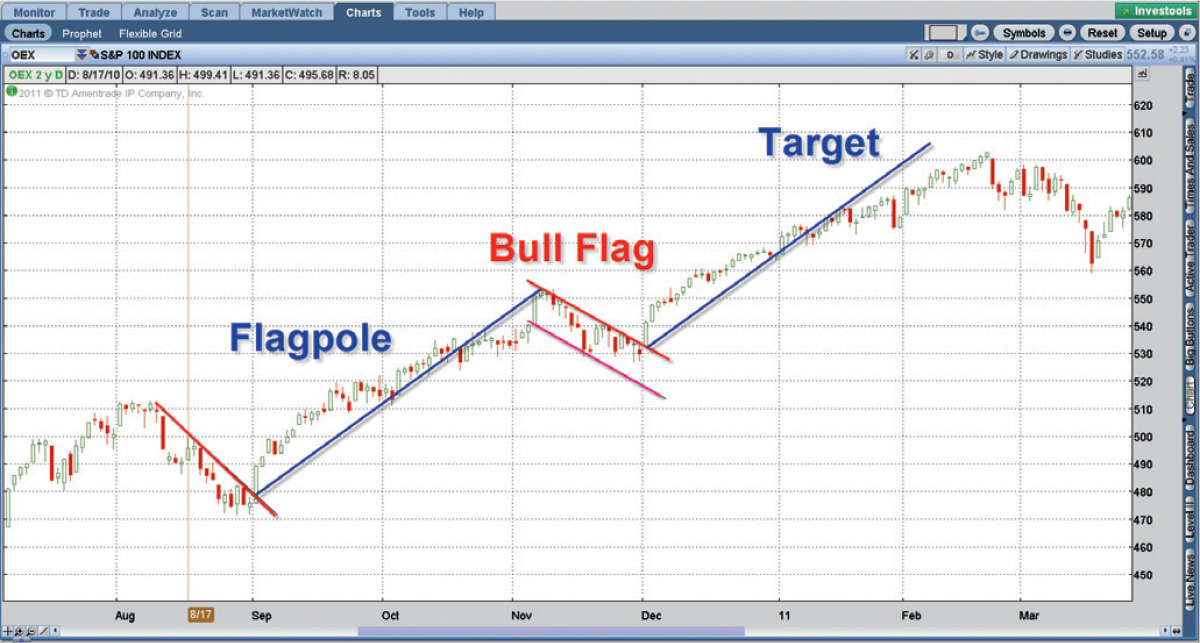

Bull bullish flag is a classic uptrend continuation pattern. The bullish flag formation appears when the.

Learn Forex Trading The Bull Flag Pattern

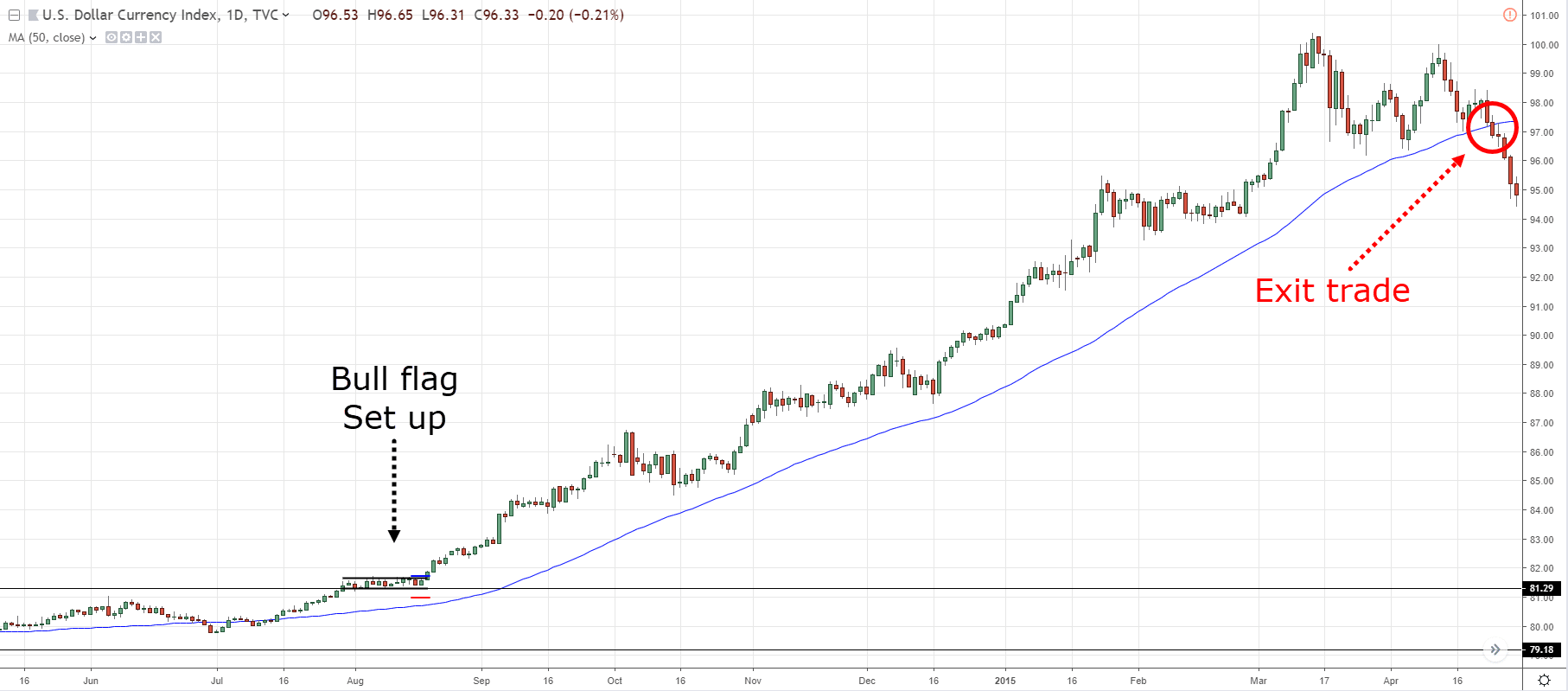

In a bull flag pattern there needs to be a 90 price rise or more within a couple months before the horizontal consolidation.

. Bull Flag Pattern is a pattern that is visible after plotting the chart. A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. The essential characteristic of this pattern is a short downward consolidation after which the instrument shows active growth.

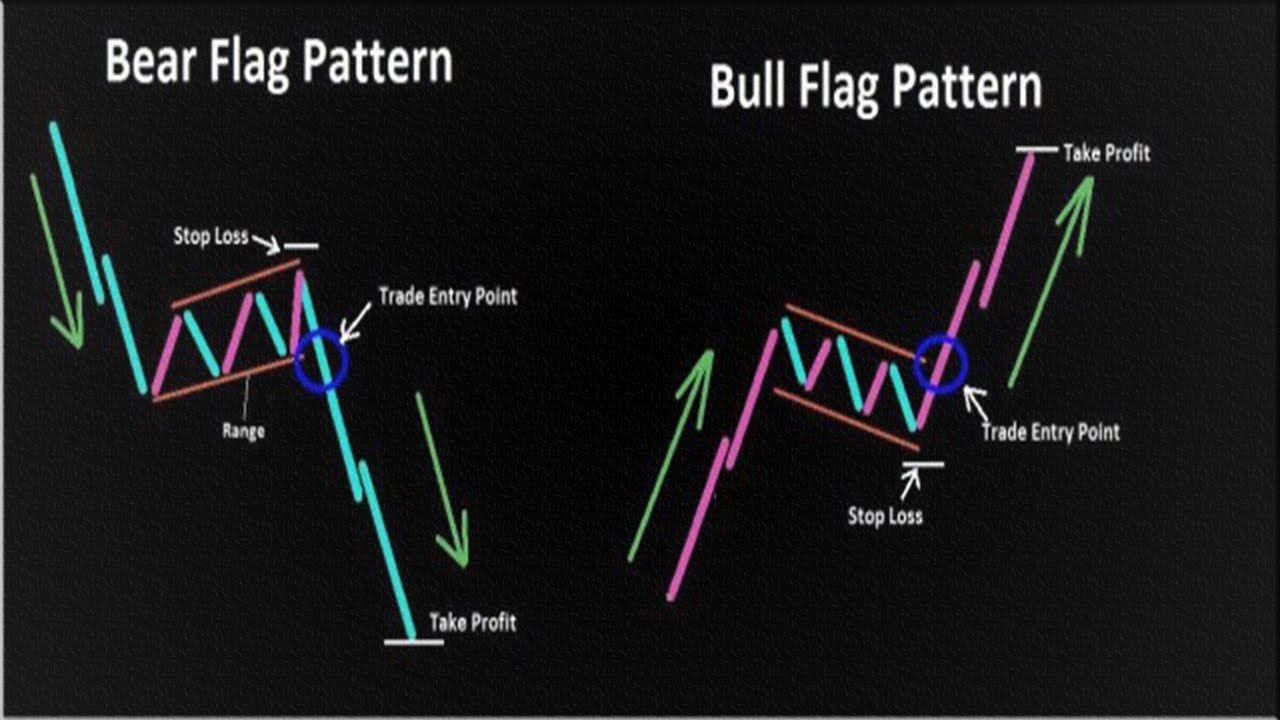

How to trade bear flag patterns. The Psychology Behind the. The bull flag should have an uptrend since its a continuation pattern and isnt a reversal.

This pattern is hard to find at the data level. A bull flag is a chart pattern often used in technical analysis and trading to identify a bullish continuation. The flagpole and the flag.

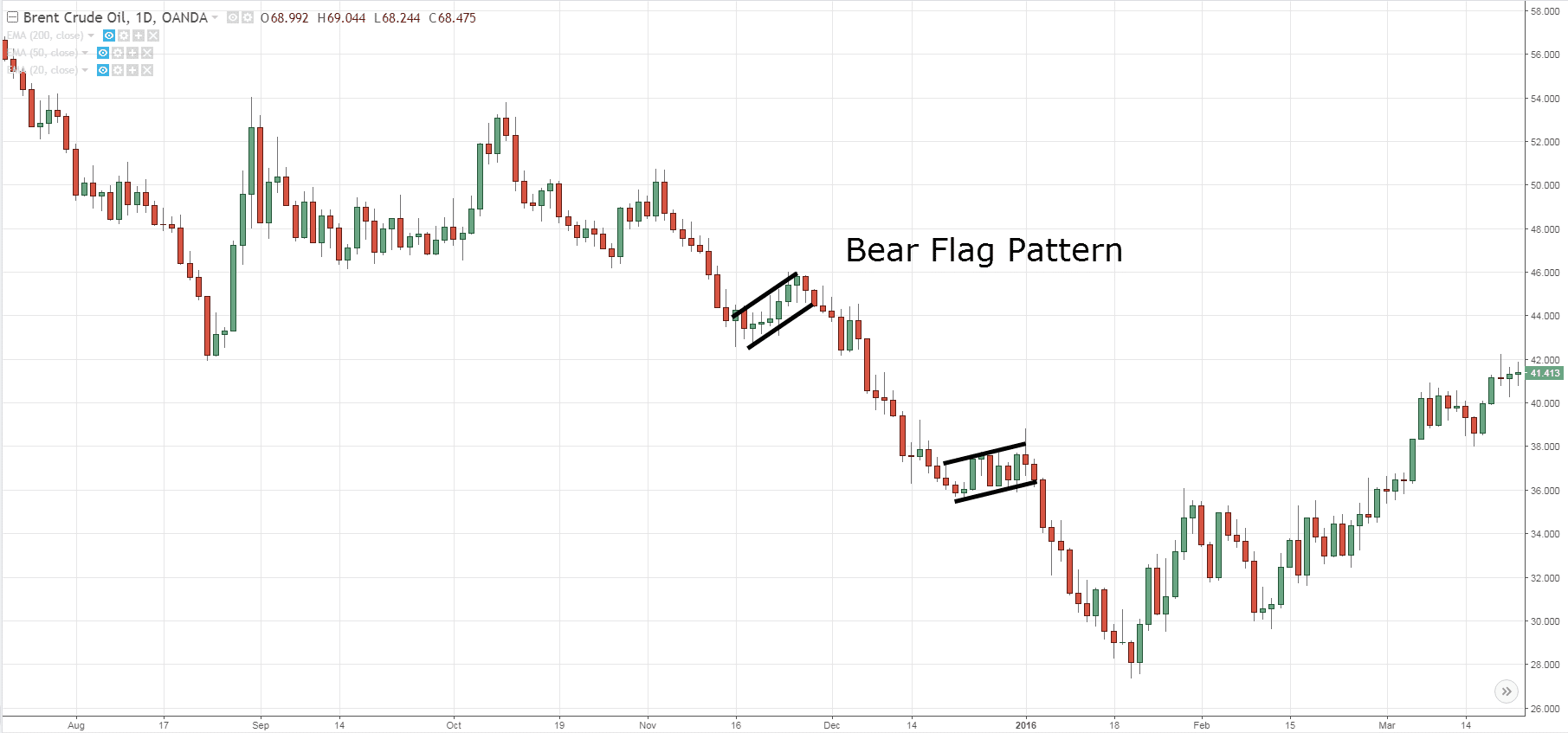

It is identical to the bull flag except the pole is a move to the downside and the flag is either sideways or upward. The best times to trade the Bull Flag Pattern is just after the market break out during a strong trending market. According to me finding pattern in an image using Deep Learning.

The bear flag starts with a significant fall in prices followed by a period when the price remains. This pattern is reliable for the same reasons. The pattern occurs in an uptrend wherein a stock pauses for a time pulls back to some degree and.

A bull flag pattern typically appears in an uptrend following a sharp rise price that extends a stock or other financial security to a new near-term high. Look for at least 3 or more consolidation candles that moves to resistance levels. Watch for a bearish candlestick that forms a flag pole.

It consists of a strong rally followed by a small pullback and consolidation. When the prices are in an uptrend a bullish pattern shows a. It occurs when a stock or other security trades in a sideways range after.

The bull flag formation is a technical analysis pattern that resembles a flag. A follow-up rally is likely when. There are two main price levels that make up the bull flag pattern.

The Bull Flag Pattern is a bullish continuation chart pattern. The pattern formed by inverting the bull flag stock pattern is called the bear flag stock pattern. The bull flag is an easy-to-learn pattern that shows a lull of momentum after a big rally.

Anything less than that and you have a less bullish flag pattern. You may say its a bull. A bull flag is a bullish stock chart pattern that resembles a flag visually.

When the correction begins and the price drops.

How To Trade Bull Flag Pattern Six Simple Steps

Pennant Flag Pattern Comparison Warrior Trading

Bull Flag And Bear Flag Chart Patterns Explained

The Bull Flag Pattern Trading Strategy

Bullish Flag Chart Patterns Education Tradingview

The Bull Flag Pattern Trading Strategy

How To Use The Flag Chart Pattern For Successful Trading

Bull Flag Price Action Trading Guide

A Market Signal Bull Flags Ascending Triangles And Ticker Tape

Bull Flag Stock Chart Pattern Illustration Stock Photo By C Boscorelli 301709120

How To Trade Bull And Bear Flag Patterns Ig Us

Stock Charting Tips Leading The Charge With Bull Fla Ticker Tape

Bullish And Bearish Flag Patterns Stock Charts

Bull Flag Chart Patterns The Complete Guide For Traders

What Is A Bull Flag Pattern Bullish How To Trade With It Bybit Learn

How To Use Bull Flag Entries And Price Targets Youtube

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

How Does The Bull Flag Pattern Trading Strategy Work The Intelligent Investor